Credit affects your ability to make numerous life decisions. Your credit can affect purchasing a home, having your loans approved, and even your likelihood of receiving employment.

So how can you ensure that you are practising good credit health? First off, you want to have good credit, which is easier said than done. If you have let your credit score slip over the years then building it back up will take time and diligence, but you can do it. In fact, we have created a guide to help you get started.

How to Improve Your Credit

Pay off your debts

This is a good place to start if you are looking to see immediate improvements to your Credit Score. While you are at it, see if you can go beyond than just paying off your minimum payments. Doing so will show potential lenders that you are taking active steps to improve your financial health.

Don’t miss or be late on your payments

Either missing or being late on your payments can stack up against your credit history fast. In fact, these entries will stay on your history for 6 years. Make sure you contact your credit provider if you miss a payment for a reason outside of your control. They may be able to remove the mark from your history that would otherwise affect your credit score.

Keep tabs on your credit file

Check your credit report. You should make sure that everything on your report is accurate.

Build your credit history

Chances are if you are young, or have avoided entering any engagements that involve repayments, your credit history is pretty much non-existent. If this is the case lenders may have a hard time assessing you. In order to build up your credit history, you should consider starting your first line of credit with a credit card. You should make some purchases on it each month and then pay them back in full to demonstrate your ability to make repayments.

Close all unused lines of credit

Lenders will look at the amount of credit you have access to. You should close credit cards, store cards, and accounts such as mobile contracts that you aren’t using. It will not suffice to discontinue using any lines of credit, you should contact your credit provider to close the account(s).

Get on the electoral roll

Getting on the electoral roll will improve your credibility with lenders. It allows them to confirm where you live and that you are who you say you are.

Cut ties with harmful financial partners

Having a joint bank account or mortgage with another person creates a financial connection that can affect your credit. If the person you are connected with has poor credit it can impact your credit as well. If you have separated from the person you share finances with making sure to let the reference agency know in order to avoid their financial lifestyle from affecting yours.

Space out credit applications

Lenders can see each time that you apply for credit, so trying to apply at mass could potentially hurt your credit score. Try to only apply if you know you will be accepted and frankly don’t apply for products unless they are a necessity.

Be careful when using payday loans

It can be seen as poor money management by lenders. Additionally making cash withdrawals with your credit card can have the same effect.

Don’t switch employers too often

This may not always be easy but if you can, refrain from switching employers frequently, especially if you are seeking credit. Lenders see a stable income as a higher likelihood of you making repayments. Staying with an employer for about five years can greatly improve your relationship with lenders.

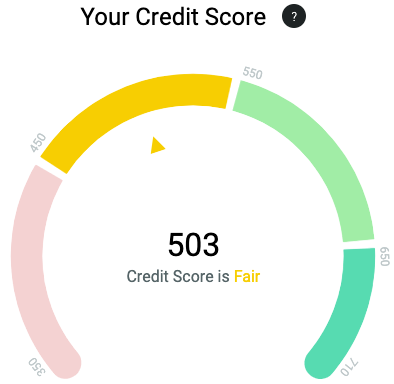

Like mentioned before, there is no universal credit score in the UK. Lenders create their own scores based on your financial habits and history. At ScoresMatter, we provide instant access to your credit report and score so that you can create your own strategy to improve your standing.

Tap Into The Digital You at ScoresMatter to start raising your credit score today.