Understanding Credit Reports and Scores

Each year, millions of people in the UK apply for loans, insurance, or jobs. In many cases, lenders, insurers, and employers assess an applicant’s financial reliability by reviewing their credit report and credit score. These reports help determine whether an individual is financially responsible and capable of managing credit effectively.

How Lenders Use Credit Reports

When applying for a loan, lenders pull a credit report to assess your creditworthiness—essentially, how likely you are to repay borrowed money. While your credit score plays a significant role, lenders often use their own ranking systems alongside this score to make final decisions.

The UK’s Main Credit Reference Agencies

There are three major credit reference agencies (CRAs) in the UK:

-

- Experian

- Equifax

- TransUnion

These agencies collect and store financial data, which lenders use to generate credit reports. TransUnion, our trusted partner, serves a significant portion of the UK market, providing detailed credit insights to consumers.

What Our Credit Report Tool Offers

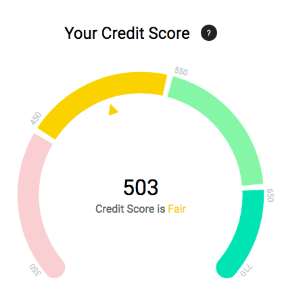

Our Credit Report tool, powered by TransUnion, gives you direct access to your credit report and score. With this tool, you can:

-

- Track changes in your score – Understand why your score fluctuates over time.

- Receive alerts – Get notified about new information added to your report.

- Check for errors and fraud – Identify mistakes or suspicious activity that may impact your creditworthiness.

- Monitor trends – See how your financial habits affect your credit score over time.

Improving Your Credit Score

Beyond viewing your report, we provide tips and insights that could help you improve your credit standing. By following our guidance, you can get a better understanding of your credit report and how it can impact you.

Additionally, our Loan Affordability and Dark Web Scan tools complement your credit report, making it easier to manage your financial health and security.

Take Control of Your Financial Future

Tap Into The Digital You at ScoresMatter and secure your financial future today.