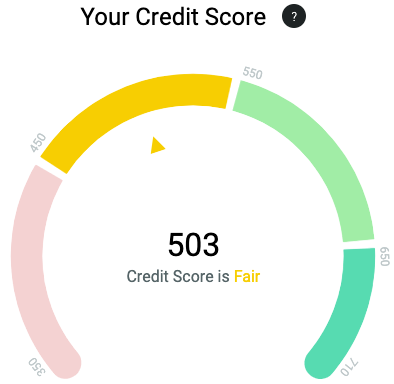

If you’ve recently paid off a significant debt, you’re likely wondering how soon your credit score will begin to reflect your financial achievement. While the exact timeline for a credit score to rise can vary, understanding the factors at play can help you set realistic expectations. In this article, we’ll explore how long it typically takes for credit scores to improve post-debt and outline simple steps you can take to boost your score.

How Long Does It Take for Credit Scores to Rise Post-Debt?

Paying off debt is a significant milestone, but seeing the effects on your credit score isn’t always immediate. Several factors influence how quickly your score will rise after clearing debt:

- Type of Debt Paid Off

- Revolving Debt: If you’ve paid off revolving debt, such as credit card balances, you might see an improvement in your credit score within a month or two. Credit utilisation is a major factor in your credit score, so reducing your utilisation ratio by paying off balances can lead to a quicker boost.

- Installment Debt: Paying off installment debt, like a personal loan or mortgage, may not have as immediate an impact. While it reduces your overall debt burden, the closure of a long-term account can sometimes lead to a temporary dip before your score stabilises and improves.

- Credit Utilisation

- Immediate Impact: Once the payment of a revolving debt is reported to credit bureaus, your credit utilisation ratio will decrease. This is usually reflected in your credit score within the next billing cycle, leading to a possible increase in your score.

- Payment History

- Ongoing Effect: Consistently making on-time payments over months and years is critical. If you’ve struggled with late payments in the past, your score will gradually improve as these late payments become older and less impactful on your overall credit history.

- Timeframe for Score Improvement

- Short-Term Gains: For smaller debts, you may start seeing improvements in your credit score within a few weeks to a few months. For more significant debts or those involving derogatory marks (like defaults or CCJs), it could take six months to a year to see substantial progress.

- Long-Term Recovery: If your credit score was severely impacted by debt, full recovery can take years. Defaults, bankruptcies, and other severe financial events stay on your credit report for up to six years, though their impact lessens over time.

How to Improve Your Credit Score: Simple Steps

Improving your credit score post-debt is all about adopting responsible financial habits. Here are some simple steps you can take to help boost your score:

- Monitor Your Credit Report Regularly

- Why It Matters: Keeping an eye on your credit report allows you to spot any errors or signs of fraud that could be dragging your score down.

- How to Do It: Use services provided by the credit reference agencies (Experian, Equifax, or TransUnion) to check your credit report regularly. If you notice any inaccuracies, dispute them with the credit reference agency.

- Maintain Low Credit Utilisation

- Why It Matters: Even after paying off debt, it’s essential to keep your credit utilisation ratio low. This shows lenders that you’re not overly reliant on credit.

- How to Do It: Aim to use no more than 30% of your available credit. If possible, pay off your credit card balances in full each month to keep your utilisation low.

- Pay Bills on Time

- Why It Matters: Payment history is the most significant factor in your credit score. Late payments can significantly harm your score, so consistency is key.

- How to Do It: Set up direct debits or payment reminders to ensure all your bills are paid on time. Even if you’re only able to pay the minimum amount, on-time payments are crucial.

- Keep Old Accounts Open

- Why It Matters: The length of your credit history influences your score. Older accounts provide a longer track record of your credit management skills.

- How to Do It: Even if you’ve paid off an account, consider keeping it open. Use it occasionally for small purchases and pay them off immediately to keep the account active without incurring new debt.

- Limit New Credit Applications

- Why It Matters: Every time you apply for new credit, a hard inquiry is recorded on your credit report, which can temporarily lower your score.

- How to Do It: Only apply for new credit when necessary. If you’re planning to take out a mortgage or loan, try to avoid opening new credit accounts in the months leading up to your application.

Conclusion

Recovering from debt and improving your credit score is a process that requires patience and persistence. While you might see some immediate benefits from paying off debt, the most significant improvements come from consistent, responsible credit management over time. By monitoring your credit report, maintaining low credit utilisation, paying bills on time, keeping old accounts open, and limiting new credit applications, you can steadily improve your credit score and build a strong financial foundation for the future.

Remember if you are struggling to keep up with repayments on your debts, head over to the MoneyHelper website which has lots of advice and guidance on all things money as well as dedicated pages for debt and debt management.