Many people find credit scores to be a confusing topic. And for good reason, unfortunately. There is a wealth of misinformation floating around online that only makes matters even more unclear. With so many questions surrounding credit scores, it can be an overwhelming topic to look into. But the truth is that credit scores aren’t as confusing as they may seem. In this series of quick guides, we’ll demystify some of these misconceptions and frequently asked questions surrounding credit scores and show you just how simple they really are. That leads us to our first question:

What factors actually affect my credit score?

This is a question that has come up a lot for many people, myself included! When I first started building my credit, I was constantly concerned that I was going to do something that would end up negatively impacting my credit score. This made me so anxious that I put off even getting a credit card for years. Piece of advice? Don’t do what I did. I was uninformed, and I don’t want you to be. So today, we’ll pull back the curtain on the three biggest factors that impact your credit score the most. Let’s get right into it!

Payment History

Your payment history is by far the most impactful factor when it comes to calculating your credit score. But why, though? Well, the answer is pretty straightforward. Lenders and other financial institutions want to know that you can be reliable. If they offer you a loan or other finances, they’ll want to make sure it’s a safe bet that they’ll get their money back eventually. It’s as simple as that. Consistency in paying off your balances on time is crucial to building and maintaining a great credit score. Keep in mind that If you consistently miss payments, your credit score will drop dramatically with time.

Key takeaway: pay off your balances, and pay them off on time. Consistency is key here.

Credit Utilisation

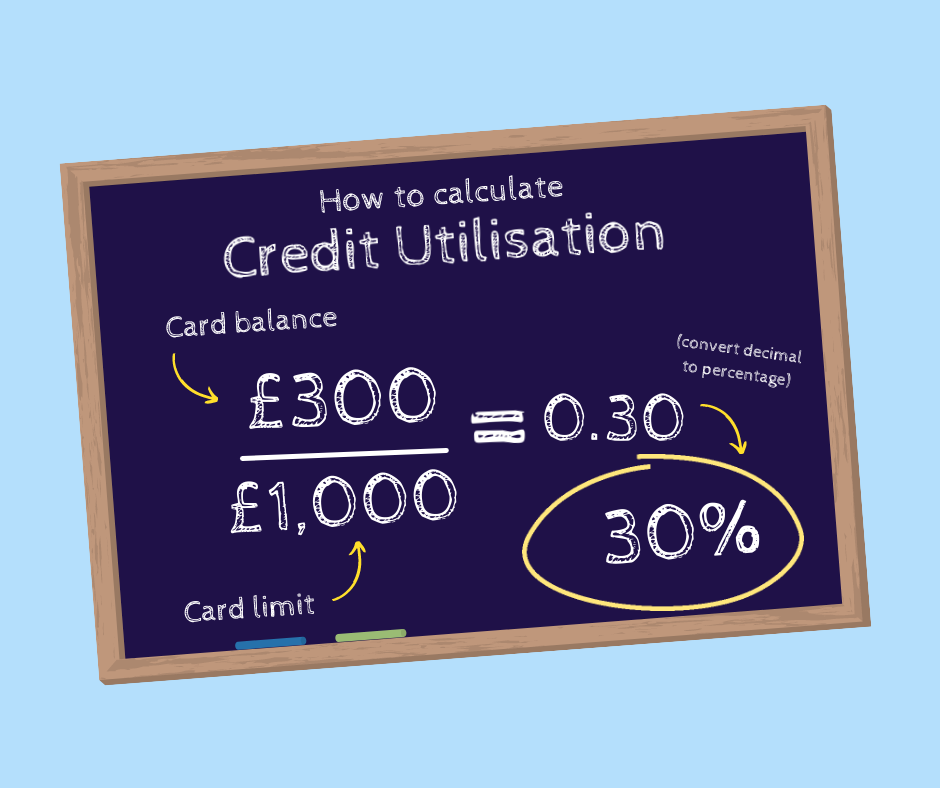

The second most impactful factor that contributes to your credit score is your credit utilisation. For those of you who may not be familiar with this term, we’ll break it down for you. Simply put, your credit utilisation is how much of your available credit you’re using at any given time. This can be expressed as a percentage, and is super easy to calculate! Check out an easy explanation below:

It’s as easy as that! Just take the balance you owe on your credit card(s), and then divide that by your credit limit(s), and you have your credit utilisation rate! That’s great, but how does it affect your credit score? That one’s also easy. It’s always smart to limit your credit utilisation as much as possible. Experts suggest keeping your credit utilisation rate at approximately 30% if at all possible. That’s because the less credit you use, the less likely you are to appear totally reliant on it. Instead, it will look more like credit is a tool that you strategically utilise, and that’ll be a positive sign to lenders or creditors! Over time, this will also help to improve your credit score.

Key takeaway: do your best to use less than 30% of your available credit if at all possible. Overusing your credit card can be a red flag, and will eventually lower your score.

Credit History

The third most influential factor that can affect your credit score is the length of your credit history. A longstanding credit history can speak volumes to a lender or financial institution when you’re in consideration for a loan, and this will be reflected in your credit score. Keep in mind, however, that a long credit history alone won’t do anything for your credit score if you have a track record of late or missed payments. For those who are just starting out and don’t have a long credit history, don’t fret. As long as you make your payments on time, this will come over time.

One other factor to consider here is what to do once you’ve paid off credit cards that you no longer plan on using. Leaving these cards open can actually help increase your credit score over time. Cards that you keep open but no longer use can still show up on your credit report for years, and their age alone over time can help boost your credit score.

Key takeaway: consider keeping old credit cards that you no longer use even after you’ve paid them off.

Sources: Credit Karma, Investopedia