When it comes to dealing with credit, there are a lot of phrases that end up getting thrown around. Credit reports, credit checks, and many other similar terms are used (and often misused) when applying for, and using personal credit. Two of these phrases that most often get confused are actually some of the most basic ones: credit score and credit rating.

While these two terms are often used interchangeably, there are a few minor differences. Today, we’ll break these two terms down to give you a better understanding of how to differentiate between them, as well as give you insight into how they reflect your overall financial health to creditors. Before we start however, it’s important to note that lenders don’t calculate credit scores or credit ratings; that falls on the three credit reference agencies in the UK (TransUnion, Experian, and Equifax). Now, let’s dive right in with credit scores.

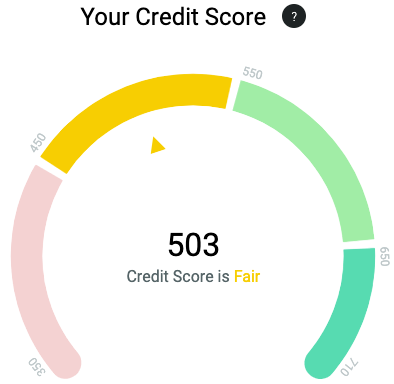

A credit score is a specific numerical value that reflects a person’s creditworthiness and likelihood to repay any credit they have applied for. This number is calculated based on the information found in your credit report. One important thing to note about credit scores is that there is no universal scale used to calculate them; each of the three the different credit agencies in the UK all use different methods to calculate the scores, and each will be different depending on the criteria they are using. With ScoresMatter, our reports come from TransUnion, meaning that your credit score will range anywhere between 350-710. The key takeaway here is that credit scores can be attributed to individuals or businesses, but are most often attributed to individuals applying for loans, credit, mortgages, or other finances.

A credit rating, on the other hand, is a bit different.

A credit rating refers to similar, but different systems that lenders use to determine creditworthiness and helps them assess the risk of offering you credit. These credit ratings can be assigned to individuals, as well as businesses or even governments. Unlike a credit score however, these systems aren’t based on fixed numerical values. Rather, think of credit ratings as grades that reflect how likely a person or institution will be to repay a loan. Again, it’s important to remember here that these ratings will differ based on the agency that is administering them, but with ScoresMatter, your personalized credit rating will be displayed on a scale of 1-5, with 1 being ‘very poor,’ and 5 being ‘excellent.’

As you can see, these two terms are very similar, and are often used synonymously. However, being familiar with the subtle differences between them will help you to better understand how they can affect your overall financial health. Next week, we’ll cover how to raise your credit rating, so make sure to check back in for those handy tips!

Sources: Investopedia, Equifax, TransUnion, Barclays