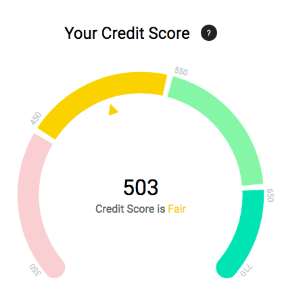

Your credit score is a 3 digit number that shows your creditworthiness. It helps lenders predict how you will treat a line of credit based on your financial history. This means it can have an effect on some of your biggest life events such as purchasing a home or securing employment.

There may be a variety of things you do that can hurt your score but did you now there are also things you may not be doin that also

Here is a list of everything you should stop and/or start doing in order to improve your score.

Stop

Applying for too many loans

Lenders can see each time that you apply for credit, so trying to apply at mass could potentially hurt your credit score. Try to only apply if you think that you will be accepted.

Your financial connections to others

If you have a previous financial connection to another individual(s), such as a joint bank account, then their bad credit could be pulling yours down. It may also continue to do so as long as the connections exist. If you cut ties with these connections you could see a difference in your score.

Keeping Unused Lines Of Credit

Lenders will look at the amount of credit you have access to. You should close credit cards, store cards, and accounts such as mobile contracts that you aren’t using. It will not suffice to stop using these lines of credit, you should contact your credit provider to close the accounts.

Using Pay Day Loans

Using payday loans can be seen as poor money management by lenders. Additionally, making cash withdrawals with your credit card can have the same effect. Stopping these practices can help improve your score.

Switching Employers

This may not always be easy but if you can, refrain from switching employers frequently. Lenders view a stable income as a higher likelihood of you making repayments. Staying with an employer for a longer period can improve your relationship with lenders.

Start

Making payments on time

Not making payments on what you owe will lower your credit score. If you start making payments on time, it will show that you are making an effort to prove you are reliable and in turn can improve

Your credit history

Chances are if you are young, or have avoided entering any engagements that involve repayments, your credit history is pretty much non-existent. If this is the case lenders may have a hard time assessing you. In order to build up your credit history, you should consider starting your first line of credit with a credit card. You should start making some purchases on it each month and then pay them back in full to demonstrate your ability to make repayments.

Registering on the electoral roll

Creditors use this address to confirm you are who you say you are. Providing this information could help your credit score. Learn how you can get on the electoral roll here.

Checking Credit Report and Score

By not checking your credit report and score, you are missing numerous opportunities to tackle problems with your credit the second they arise.

Start by signing up for ScoresMatter. We give you access to your report and score so you can monitor your credit for any of the issues mentioned above. We also provide you with content that can educate you about your credit.

Tap Into the Digital You at ScoresMatter and start improving your credit today.